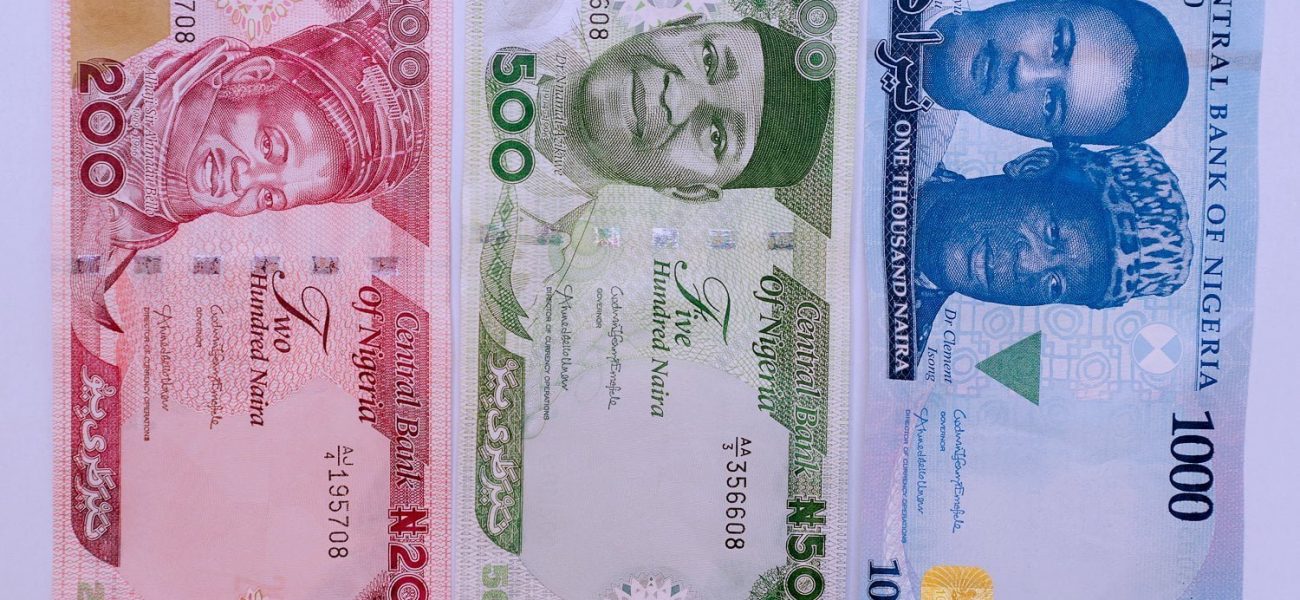

What should ordinarily be a carefully thought out, well-choreographed economic programme of currency replacement in any economy has turned into disarray in Nigeria. On October 26, 2022, the Central Bank of Nigeria (CBN) announced that it was introducing newly designed notes to replace the existing high-end currency notes of N200, N500 and N1,000 notes. This otherwise simple task has turned out complicated and chaotic. Citizens have been forced to struggle, squabble and suffer to lay their hands on the new notes. It has also seen State Governors sue the Federal Government, asking for the Supreme Court to exercise its original jurisdiction and halt the implementation of the new notes policy. Notedly, States suing the Federal Government are controlled by the ruling All Progressives Congress (APC) of President Muhammadu Buhari, implementer of the policy.

The period of introducing the new currency notes and the announced end of old notes spanned only six weeks. Towards this deadline, the Central Bank stated that it had withdrawn over N2 trillion from circulation. What it did not tell Nigerians was how much of the new notes it printed. This appears to account for the chaos and confusion that the policy has generated. Sources appearing to have this information indicate that the CBN may have printed only about N300 billion of the new notes – a drop in the ocean considering the amount of old notes withdrawn. While the CBN may have been pursuing an attempt to reduce use of cash in the country, many parts of the country have no bank operation in place. Low earning citizens and the average person prefer to transact in cash. Coupled with this, the banking technology appears antiquated. Technology used in banking apps and transactions constantly fail. Citizens using existing technology find that monies authorised for transfers or withdrawals through Automated Teller Machines (ATMs) get missing in the ‘pipeline’. To worsen matters, citizens find that monies deposited in banks disappear or reduce at an incredible rate owing to multiple bank charges, some even fraudulent, with bank staff conniving with criminal elements to fleece customers of money deposits in their accounts.

Although the cash crunch and pains appear to be unabating, Nigerians at this time are focused on casting their votes in the general elections that will be holding in only a few days. There is no doubt that the pains and suffering of Nigerians arising from the immediate issue of cash crunch, in addition to lingering complaints of failure of government could provide a huge impetus for citizens to troop out to vote.